capital gains tax proposal canada

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Person clients living in Canada who sell assets Mr.

Marginal Tax Rates For Each Canadian Province Kalfa Law

A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates.

. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. Capital gains are part of the taxpayers comprehensive income and in a fair and efficient tax system they should be subject to taxation just like other income. In 2019 and 2020 some media outlets reported on the possibility that the government might introduce a Canada home equity tax on peoples primary residences.

In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. And the tax rate depends on your income.

If you sold property in 2021 that was at any time your principal residence you must report the sale on Schedule 3 Capital Gains or Losses in 2021 and Form T2091 IND Designation of a. Capital gains x 50 Inclusion rate x Your. Says the think tank Brookings.

The inclusion rate for personal. In Canada 50 of your realized capital gains are included as part of your taxable income and taxed at your marginal tax rate. Its taxed at your marginal tax rate just like any other income.

In Canada 50 of the value of any capital gains is taxable. Divide that number in half 50 and that. The basic formula for calculating capital gains is the following.

This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the. Your sale price 3950- your ACB 13002650. Feb 7 2022.

On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. For a Canadian who falls in a 33 marginal. Capital gains tax in Canada In.

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. The Presidents proposal moves capital gains taxation in the United States directly toward how weve done it in Canada for the last 40 years. The Canadian government first introduced capital gains taxes in 1972 but exempted primary homes from taxation in a bid to encourage home ownership.

One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an. The leading plans lowering the top capital gains rate from 28 to 20 or less and indexing capital gains for inflation would spur tax shelters. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in. While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US. Heres a short explanation of what is.

While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US. The NDP Hitting Canadian Homes With A 75 Capital Gains Tax Wouldnt Change Much September 1 2021 Canadian real estate and capital gains taxes are once again in the. Election platform the NDP proposed to increase the capital gains inclusion rate to 75 from 50.

Archived Tax Planning Using Private Corporations Canada Ca

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

High Income Earners Need Specialized Advice Investment Executive

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

This Week In Coins Prices Continue Downward Central African Republic Adopts Bitcoin Canada Says Nah Wa In 2022 Central African Republic Central African Republic

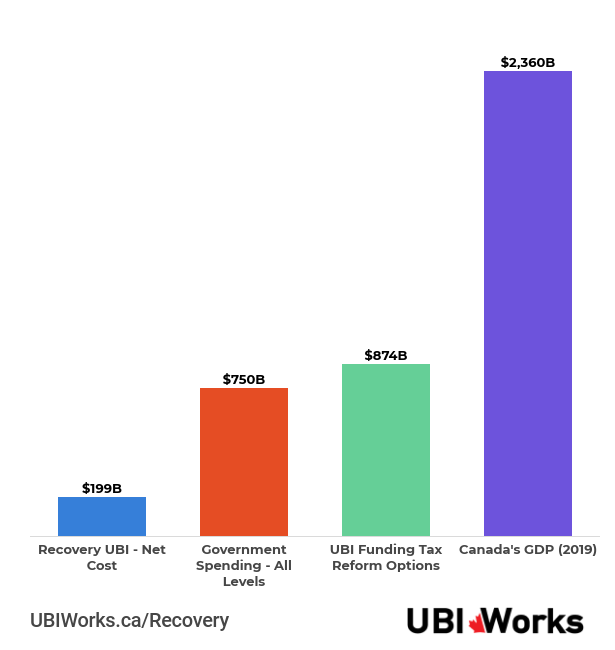

8 Ways To Pay For A Recovery Universal Basic Income

Tax Brackets Canada 2022 Filing Taxes

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

What Are Marriage Penalties And Bonuses Tax Policy Center

Pin By Canada Immigration Guide On Http Canadaimmigrationpath Com How To Apply Permanent Residence Instruction

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation